Okay, this is just a little bit of me thinking out loud.

According to the Direct Loan site, my current payoff amount (that’s principal outstanding balance plus interest) is $89,178.15. Starting next month, I’m going to start paying down my interest. I’ll be able to do this since I have a part time job as a research assistant, and I have a loan surplus because I really borrowed too much in the first place. Before I begin this little endeavor, though, it’s important that I be aware of my past financial mistakes so that I can put everything in perspective.

Now, I’d love to have financial records stretching back into my toddler years, but as far as I’m concerned the day I started law school is the day my financial life started. Everything before that is a dark and brutal prehistory.

Financial Prehistory

College was a mess; I had plenty of work-study income coming in, but I also had plenty of alcohol to drink and inconsequential shit to buy. Fortunately my $160k+ undergrad tuition was taken care of by financial aid, a college savings account, and my Dad. I did work at a relatively normal job for a year after college, if normal means growing bacteria and neurons, dissecting rodents, and using things too small to see under a microscope to mess with more things too small to see. And that normal job paid; not super well, but well enough. Of course, over the course of that year and the subsequent year of traveling and studying abroad I spent the entirety of that salary.

So I considered myself at net zero worth at the start of law school. Loans, of course changed that. But I had nevertheless entered into a more stable financial time and the matter of borrowing and spending started to claw at corners of my awareness. Rather then my accounts being a sort of black box, I would note my statements and try and keep aware of what I was doing, even if I wasn’t changing my behavior. Eventually, I joined Mint.com (before it was acquired!) and got everything centralized (by everything I mean my loans and my one checking account).

The Grand Total Thus Far

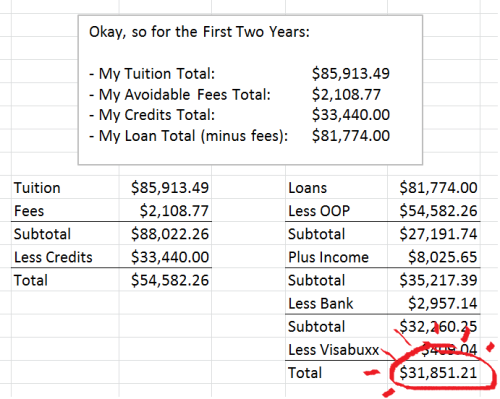

Despite all this, I’d never really gone through my overall financial situation step by step. Well, I have now, and here’s the big picture, the Total indicated below is the total spent aside from school tuition:

So on the positive side, about a third of the tuition (which more or less comes out to $45k a year) was paid for through my school scholarship and a few other school related credits. Also, over the course of two years I have had a small $8k income that came in through my research assistant gig and gifts.

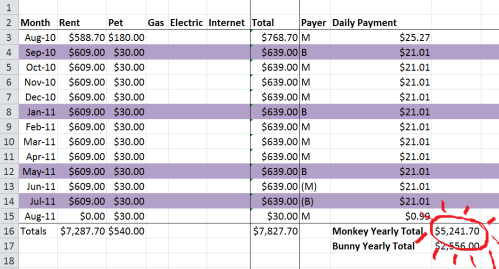

Nevertheless, the huge problem here is that I spent $31k in these two years. That may not be a lot, compared to some average middle class or upwards person, but I think that in my position thirty grand is excessive. Now, not all of that was waste. I had books to buy, rent to pay, a summer program to attend, plane tickets, patent bar prep materials, and so on. But I am more than certain that a painfully wasteful amount of it could have been avoided had I adopted a more frugal mindset earlier on.

In the Upcoming Year

As for this final year’s tuition and loans, I’ve taken out a total of ~$42,500, which will kick back a sum of about $12,000 for living expenses and such. According to my calculations for rent, I will spend at least $5,200 on rent, and will probably have to add a thousand dollars or so to that in order to cover utilities.

I’ll have to work out a budget for food, books, etc., but overall it looks like I’ll have a couple thousand left over at the end of the year. Part of that will be an emergency fund for post-graduation, or I’ll used a chunk of it to pay off more interest. We’ll see.

So, to sum up, I’ve got my big picture finances squared away, I’m working on a rough yearly budget for next year, and I’m planning on starting to pay down the interest once a month, with any and all income that comes into my bank account.